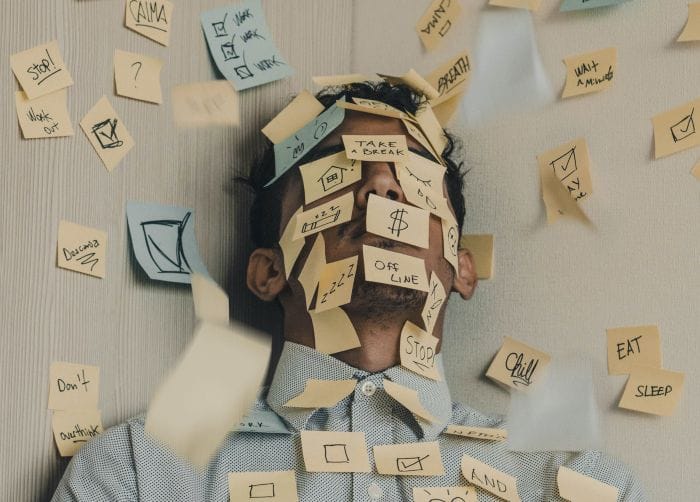

4 Steps to Improve Your Mental Health through Financial Wellness

In honor of Mental Health Awareness month, we’re digging into the link between financial wellness and mental health, along with four strategies for strengthening your finances.

Recent studies show that there’s a strong link between financial wellness and mental health, meaning a person’s financial health is linked to their overall wellbeing. In honor of Mental Health Awareness Month, we’re digging into the link between financial wellness and mental health, including how you can improve your finances to support your mental health.

How Does Financial Wellness Impact Mental Health?

Around the world, people have been through a lot in the past few years. The COVID-19 pandemic has caused immense stress on many families and individuals, impacting mental health for everyone. While uncertainty and the fear surrounding coronavirus are a significant part of the stress, financial stress is weighing heavily on many people.

The pandemic brought with its layoffs and work hour reductions. Meanwhile, the cost of living has continued to climb and inflation is an ongoing concern. With less income and more expenses, many families are feeling the pandemic burn into their savings, causing overall stress and hardships in their life.

Outside of the COVID-19 pandemic, finances have always been linked to mental health. Unfortunately, poor mental health can negatively impact financial wellness, which in turn can cause more mental health challenges. It’s a cyclical problem where someone may be too depressed to manage their finances, but then finds themselves in so much debt and late bills they experience increased anxiety.

Even without an existing mental health challenge, debt or a lack of savings can lead to hardships in life, including divorce, poor health, and even depression. According to a Money and Mental Health study, “Almost one in five (18%) people with mental health problems are in problem debt. People experiencing mental health problems are three and a half times more likely to be in problem debt than people without mental health problems (5%)”.

How Can I Improve Financial Health?

Mental health is incredibly nuanced and improving your financial wellness is not a solve-all strategy for health. However, these strategies can be a great way to build a strong foundation you can build on to ensure your financial wellness doesn’t suffer when you struggle with mental health and that your finances don’t cause further psychological strain.

Improve Your Financial Literacy

Having a strong understanding of financial literacy is the most important place to start. By familiarizing yourself with best practices and common misconceptions, you can avoid a lot of missteps that can lead to stress down the line.

Improving financial literacy is something you can work on as a family. If you have kids at home, make them part of the conversation (in an age-appropriate way). You can also find nonprofits such as bunny.money's partner My Money Workshop offers great financial education opportunities and resources.

Build an Emergency Fund

Many Americans (44%) could not cover a $1,000 emergency expense such as a car repair or an unexpected medical bill. Building an emergency fund ensures you won’t need to go into debt by taking out a loan, using a high-interest credit card, or borrowing money from family.

Stick to a Budget

Building and sticking to a budget is the best way to ensure you live within your means. Create a budget for your regular household expenses. Include how much you plan to save for the future and how much you want to give to causes you care about.

If you don’t yet have an emergency fund, that should be your first step. Once you’ve built up that fund, you can begin saving for other goals, making charitable donations, and creating a flexible spending category.

As your situation changes, such as getting a raise or buying a home, be sure to adjust your budget accordingly. Be aware of lifestyle creep, which can keep you from saving more as your income increases.

Support Those Around You

When you have friends or family that are irresponsible with their money, it’s hard not to take on their stress. Especially if those people are always asking to borrow money or complaining about their financial changes, you may find yourself worrying about them.

First and foremost, it’s not your job to stress about anyone else. It can definitely be hard not to worry about others, but you can’t control their situation. One way you can help is to encourage them to improve their financial literacy. Whether it’s by recommending books (or our blog!), you can help share valuable skills with those around you.

Protecting Your Mental Health

There are many factors that influence mental health. Especially during the stress of the pandemic and concerns about inflation, many people have felt uncertain about the future.

It can help to limit your worries to what you can control. You’ll never be able to change the federal interest rate or manage inflation. However, you can be disciplined about budgeting and building a savings buffer.

Give to causes you care about when you’re able. There are many benefits to donating to charity, including a greater sense of gratitude, community, and purpose. Don’t stress about donating a specific amount annually, but giving as you can is a great way to feel better about your impact. You can also donate your time by volunteering if you’re not yet in a position to make a financial donation.

How Extra-Ordinaire Makes a Difference

We talked with Pauline Mottet, founder and executive director of Extra-Ordinaire, a nonprofit organization on a mission to empower athletes to champion their life after competitive sports.

After conducting over 60 interviews with athletes across the United States and Europe, she reports that half of them put financial stress as their top struggle after their career ends.

Not all sports are equal, and athletes' income varies greatly depending on the sport they practice and the media attention they get. Therefore, they don’t start with the same financial resources to sustain their life after competition. But in a very short period, they all need to adjust their lifestyle to their new (or lack of) income. It is a big change since many of their former teammates and relationships may still be active athletes with various incomes and benefits. They may have to say no to participating in some events for example.

“59% [of Olympians and Paralympians] reported making less than $25,000 during the year of their respective Olympics, according to a survey distributed to 4,400 athletes by the United States Olympic & Paralympic Committee.”

To start their new professional life, money is needed for almost everything: paying for university studies, courses to develop new skills, or even paying medical bills for the ones who were injured. And that's in addition to maintaining their own family budget for living expenses.

The financial stress that comes with this transition has an additional impact on their mental health, while they already go through a lot. For example, going back to school is seen as regression and younger athletes are more inclined to compare themselves to others of the same age who have a job and stability. Stopping intensive training means their body changes, which requires a different diet, and routine and the process of accepting it can be long and challenging.

That’s why Extra-Ordinaire decided to make an impact on this specific topic and proposed to former and transitioning athletes to connect and follow a mentorship program.

This allows them to focus on knowledge sharing, building new connections, getting emotional support as well as knowing how to adjust their lifestyle, manage finances, diversify and develop new income streams.

Give Your Finances a Boost

Your mental health is incredibly important. If you’re struggling, seek out professional support. As you’re able, explore how you can solidify your financial foundation to support your health, instead of harming it.

bunny.money is the saving and giving app designed around your unique financial situation. Download bunny.money to start saving for your future and giving to causes you care about based on your financial wellness.

captions: How-money-affects-our-mental-health